age long term care insurance 2021" width="" height="" />

age long term care insurance 2021" width="" height="" />The information and data provided below from the American Association for Long-Term Care Insurance is based on data researched or gathered by the organization. Information may be used with proper citation (Data from the American Association for Long-Term Care Insurance, www.aaltci.org) unless as indicated otherwise. THANK YOU..

Mutual of Omaha

Trivent Luteran

National Guardian Life

New York Life

Northwestern Mutual Life

Bankers Life

Policy costs can vary significantly as can benefit plan options between these carriers. It is vital (in the opinion of the Association) to connect with a specialist able to educate and compare. List does NOT include companies offering linked-benefit LTC options.

PERCENTAGE DIFFERENCE BETWEEN LOWEST & HIGHEST PRICES - with the 3% Option

Couple (57%)

Rates above are for an initial pool of benefits equal to $165,000 (each at age 55). Value of benefits when policyholder reaches age 85 equals $222,400 each (@1%), $298,900 (@2%) or $400,500 each (@ 3%). Prices for State of IL. Prices can vary by State. Calculated: January 2022 and subject to change by the various insurers.

| Annual Premium - Purchase Age 60 | ||

|---|---|---|

| Single Male, Age 60 (Select Health) $165,000 level benefits | $ 1,175 | |

| Single Male, Age 60 (Select Health) benefits grow at 1% yearly | $ 1,600 | |

| Single Male, Age 60 (Select Health) benefits grow at 2% yearly | $ 2,000 | |

| Single Male, Age 60 (Select Health) benefits grow at 3% yearly | $ 2,525 | |

| Single Male, Age 60 (Select Health) benefits grow at 5% yearly | $ 3,800 | |

| Single Female, Age 60 (Select Health) $165,000 level benefits | $ 1,900 | |

| Single Female, Age 60 (Select Health) benefits grow at 1% yearly | $ 2,550 | |

| Single Female, Age 60 (Select Health) benefits grow at 2% yearly | $ 3,300 | |

| Single Female, Age 60 (Select Health) benefits grow at 3% yearly | $ 4,300 | |

| Single Female, Age 60 (Select Health) benefits grow at 5% yearly | $ 6,600 | |

| Couple Both Age 60 (Select Health) $165,000 level benefits | $ 2,600 combined | |

| Couple Both Age 60 (Select Health) benefits grow at 1% yearly | $ 3,525 combined | |

| Couple Both Age 60 (Select Health) benefits grow at 2% yearly | $ 4,525 combined | |

| Couple Both Age 60 (Select Health) benefits grow at 3% yearly | $ 5,800 combined | |

| Couple Both Age 60 (Select Health) benefits grow at 5% yearly | $ 8,750 combined | |

| Annual Premium - Purchase Age 65 | ||

|---|---|---|

| Single Male, Age 65 (Select Health) $165,000 level benefits | $ 1,700 | |

| Single Male, Age 65 (Select Health) benefits grow at 1% yearly | $ 2,165 | |

| Single Male, Age 65 (Select Health) benefits grow at 2% yearly | $ 2,600 | |

| Single Male, Age 65 (Select Health) benefits grow at 3% yearly | $ 3,135 | |

| Single Male, Age 65 (Select Health) benefits grow at 5% yearly | $ 4,200 | |

| Single Female, Age 65 (Select Health) $165,000 level benefits | $ 2,700 | |

| Single Female, Age 65 (Select Health) benefits grow at 1% yearly | $ 3,400 | |

| Single Female, Age 65 (Select Health) benefits grow at 2% yearly | $ 4,230 | |

| Single Female, Age 65 (Select Health) benefits grow at 3% yearly | $ 5,265 | |

| Single Female, Age 65 (Select Health) benefits grow at 5% yearly | $ 7,225 | |

| Couple Both Age 65 (Select Health) $165,000 level benefits | $ 3,750 combined | |

| Couple Both Age 65 (Select Health) benefits grow at 1% yearly | $ 4,735 combined | |

| Couple Both Age 65 (Select Health) benefits grow at 2% yearly | $ 5,815 combined | |

| Couple Both Age 65 (Select Health) benefits grow at 3% yearly | $ 7,150 combined | |

| Couple Both Age 65 (Select Health) benefits grow at 5% yearly | $ 9,675 combined | |

PERCENTAGE DIFFERENCE BETWEEN LOWEST & HIGHEST PRICES - with the 3% Option

Couple (17%)

Rates above are for an initial pool of benefits equal to $165,000 (for EACH)(each at age 65). Value of benefits when EACH policyholder reaches age 85 equals $201,300 each (@1%), $245,200 (@2%) or $296,000 each (@ 3%). Prices for State of IL. Prices can vary by State. Calculated: January 2021 (Age 60 added July 2021)

| Linked-Benefit (Life Insurance + LTC) Policy - Company A - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $180,000 / Min. death benefit = $120,000 | $ 4,625 | |

| Single Female, Age 55 - Pool of LTC Benefits = $180,000 / Min. death benefit = $120,000 | $ 4,600 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company B - ONE SINGLE PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $180,000 / Min. death benefit = $130,000 | $ 75,900 | |

| Single Female, Age 55 - Pool of LTC Benefits = $180,000 / Min. death benefit = $130,000 | $ 77,000 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company C - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, Age 55 - Pool of LTC Benefits = $167,000 / Min. death benefit = $167,000 | $ 5,010 | |

| Single Female, Age 55 - Pool of LTC Benefits = $167,000 / Min. death benefit = $167,000 | $ 4,550 | |

Rates above include NO INFLATION GROWTH OPTION so benefit pool WILL NOT INCREASE. Prices can vary by State and subject to change by the various insurers. Calculated: January 2022

| Linked-Benefit (Life Insurance + LTC) Policy - Company A - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, 55 - LTC Benefits @ Age 90 = $521,850 / $226,000 growing death benefit | $ 6,300 | |

| Single Female, 55 - LTC Benefits @ Age 90 = $521,850 / $242,500 growing death benefit | $ 6,750 | |

| Linked-Benefit (Life Insurance + LTC) Policy - Company C - YEARLY PREMIUM PAYMENTS | ||

|---|---|---|

| Single Male, 55 - LTC Benefits @ Age 90 = $455,300 / Min. death benefit = $167,0000 | $ 6,710 | |

| Single Female, 55 - LTC Benefits @ Age 90 = $455,300 / Min. death benefit = $167,000 | $ 7,210 | |

Policies include a 3% annual inflation growth option so benefits increase each year the policy is in place.. Prices can vary by State. Calculated: January 2022

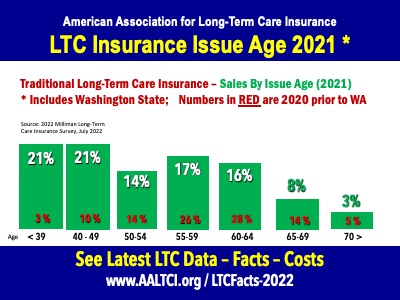

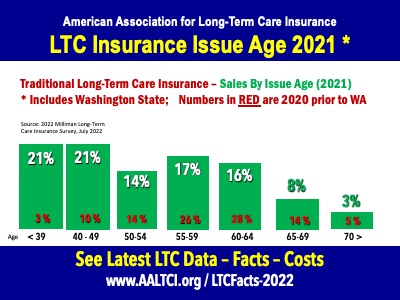

"The sweet spot for applying for long-term care insurance is between ages 55 and 65. After age 70, it becomes difficult to find and be accepted for traditional LTC insurance coverage. Numbers in 2021 skewed younger BECAUSE of the State of Washington program where many younger people applied for LTC insurance in order to avoid a tax imposed by the State of Washington," explains Jesse Slome, director of the American Association for Long-Term Care Insurance.

Note: the numbers in RED represent the 2020 issue ages. In 2020, 54% of applicants were between ages 55 and 64.

age long term care insurance 2021" width="" height="" />

age long term care insurance 2021" width="" height="" />

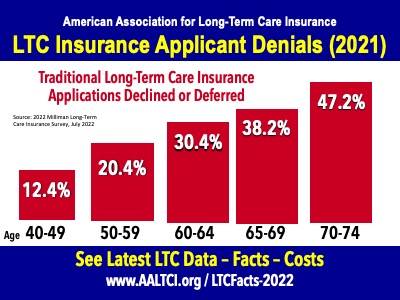

"Your money pays for long-term care insurance, but it's your health that really buys it. Insurers decline nearly half of those who apply after age 70," explains Jesse Slome, director of the American Association for Long-Term Care Insurance.

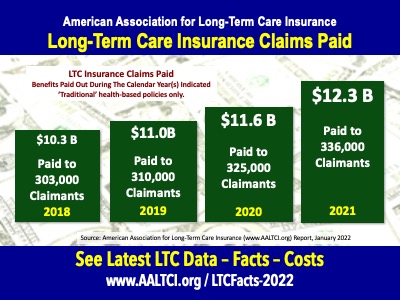

Amount of long-term care insurance claims paid for traditional LTCi policies. No figure available for hybrid or other policies.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

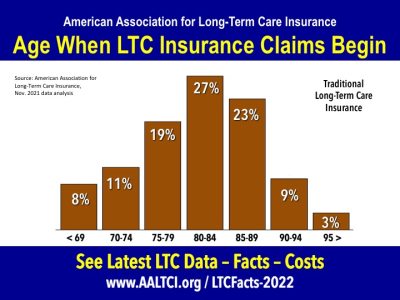

Most long-term care insurance claims begin when the policyholder is in their 80s or older. Half begin between ages 80 and 89.

age long term care insurance claims 2022 statistics data" width="" height="" />

age long term care insurance claims 2022 statistics data" width="" height="" />

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

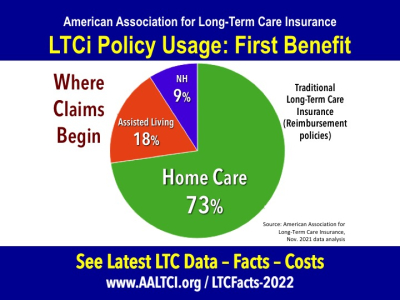

The vast majority (73%) of new long-term care insurance claims begin with care received at home. Followed by in an Assisted Living setting (18%) and finally in a skilled nursing home (9%). This data based on traditional LTCi, reimbursement models.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

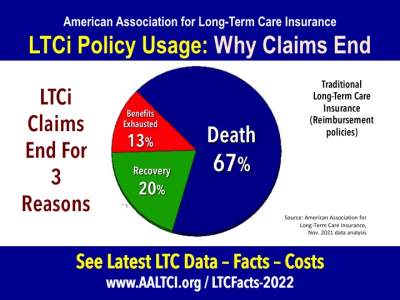

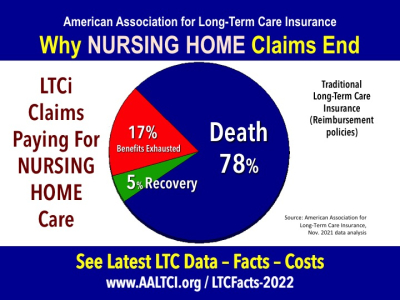

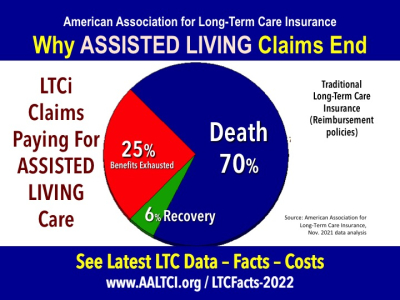

The vast majority (67%) of long-term care insurance claims end due to death of the policyholder. Note that 20% of claims end because the individual 'recovers'. They may go on claim again at some time in the future. Only 13% of the claims end because the policy benefits were exhausted (meaning they used all the available benefits). This data based on traditional LTCi, reimbursement models.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

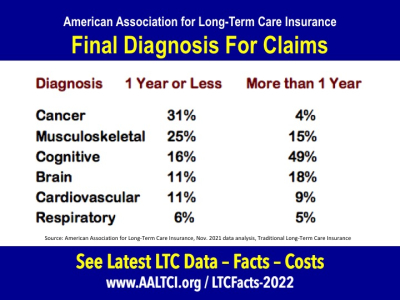

This chart looks at the final diagnosis logged for long-term care insurance claims. For claims that last 1 year or less, conditions like cancer and musculoskeletal (Common musculoskeletal disorders include: Carpal Tunnel Syndrome. Tendonitis. Muscle / Tendon strain). For claims that last longer, cognitive issues are undertandably more commong.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

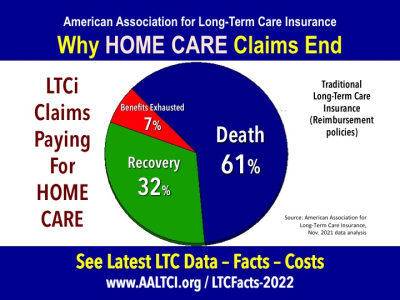

The vast majority (61%) of long-term care insurance claims that pay for care at home end because the policyholder has died. Nearly a third (32%) recover. Again, note that does mean, they might again qualify for benefits due to another future need. Some 7% of policy claims end because the policy benefits have been used up (exhausted).

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

The vast majority (73%) of new long-term care insurance claims begin with care received at home. Followed by in an Assisted Living setting (18%) and finally in a skilled nursing home (9%). This data based on traditional LTCi, reimbursement models.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

The vast majority (73%) of new long-term care insurance claims begin with care received at home. Followed by in an Assisted Living setting (18%) and finally in a skilled nursing home (9%). This data based on traditional LTCi, reimbursement models.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

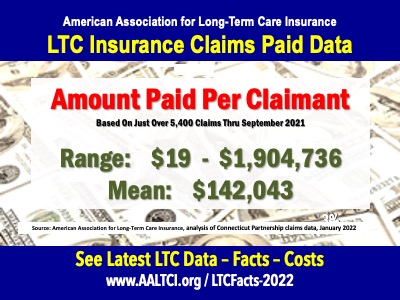

The 'mean' amount of claims paid reported thru 2021 (analysis of 5,439 claims by Connecticut Partnership for Long-Term Care) was $142,043. Some claims are small. Some are very large.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

The average is 14.8 years. The report by the Connecticut Partnership for Long-Term Care found that the age range at time of claim ran from 31-years to 101-years old. The mean was 80 years of age.

When citing data, please credit: "American Association for Long-Term Care Insurance, 2022, www.aaltci.org"

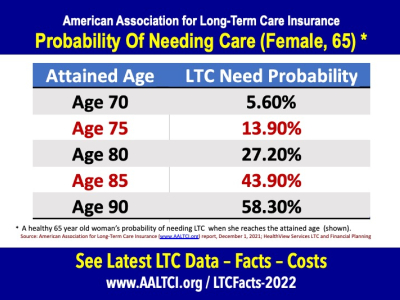

For a woman who is currently age 65, this table shows her probability of needing long-term care at different ages. It assumes she is living to the respective ages shown. Care need is defined as being unable to perform two or more of the six ADLs (bathing, continence, dressing, eating, toileting, and transferring), or, being “severely cognitively impaired”.

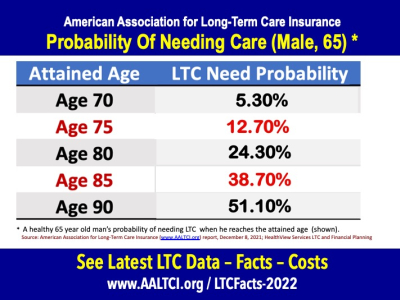

For a man who is currently age 65, this table shows her probability of needing long-term care at different ages. It assumes he is living to the respective ages shown. Care need is defined as being unable to perform two or more of the six ADLs (bathing, continence, dressing, eating, toileting, and transferring), or, being “severely cognitively impaired”.

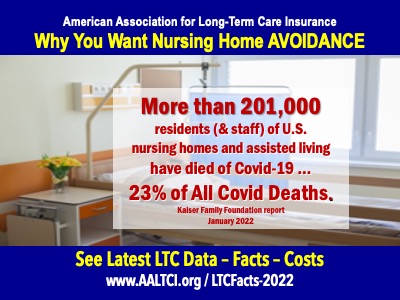

Long-term care insurance provides benefits when you need (qualifying) care IN YOUR OWN HOME. That's what people want. And, the majority of LTC insurance claims pay for care at home. Initially half of all Covid-19 deaths were in long-term care facilities. By the end of January 2022, it was still 23%.

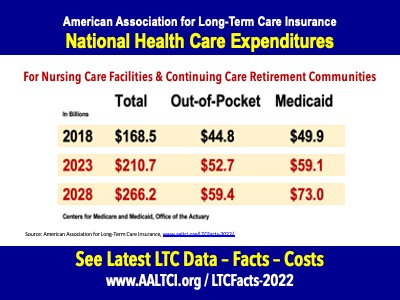

Total national expenditires for nursing care facilities and Continuing Care Retirement Communities will grow 58.4% (2018 - 2028). Projected Out-Of-Pocket expenditures will grow by 32.5% (2018 - 2028).

Analysis of data from the Medicare Office of the Actuary.

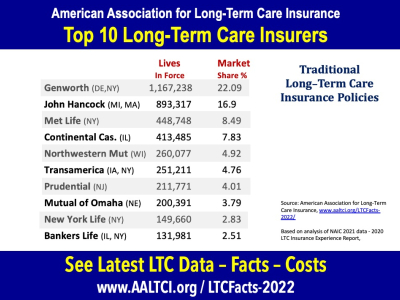

Covered lives for the top-10 insurers based on latest data for traditional (health-based) long-term care insurance policies.

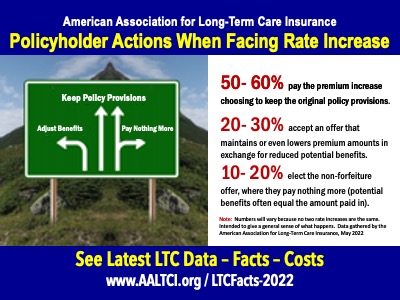

The majority keep their coverage levels (paying the increase) because they understand the value of what they purchased and are closer to needing benefits. Others adjust their policy provisions - typically reducing the inflation growth option (say from 5% to 3%, etc.).

Covered lives for the top-10 insurers based on latest data for traditional (health-based) long-term care insurance policies.

If you would like additional information please call or email Jesse Slome, Executive Director of the American Association for Long-Term Care Insurance.